House buyers with meager savings for a down payment are a great suitable for an FHA loan. The FHA has several requirements for mortgage. First, most loan quantities are restricted to $417,000 and do not offer much versatility. FHA loans are fixed-rate home mortgages, with either 15- or 30-year terms. Purchasers of FHA-approved loans are likewise needed to pay home loan insuranceeither upfront or over the life of the loanwhich hovers at around 1% of the expense of your loan quantity.

If you receive a VA loan, you can score a sweet house without any down payment and no home mortgage insurance coverage requirements. VA loans are for veterans who have actually served 90 days consecutively during wartime, 180 during peacetime, or 6 years in the reserves. Because the home loans are government-backed, the VA has rigorous requirements on the type of https://diigo.com/0inmvk house buyers can buy with a VA loan: It must be your main home, and it must meet "minimum property requirements" (that is, no fixer-uppers allowed). Another government-sponsored mortgage is the USDA Rural Development loan, which is designed for families in backwoods.

Customers in backwoods who are having a hard time economically can access USDA-eligible house loans. These mortgage are developed to put homeownership within their grasp, with affordable home loan payments. The catch? Your debt load can not surpass your income by more than 41%, and, similar to the FHA, you will be required to acquire home mortgage insurance coverage.

Lenders will wrap your existing and brand-new home loan payments into one; when your house is offered, you settle that home loan and re-finance. House owners with outstanding credit and a low debt-to-income ratio, and who don't require to fund more than 80% of the two houses' combined worth. Meet those requirements, and this can be a simple method of transitioning between 2 houses without having a meltdownfinancially or emotionallyin the procedure.

No matter what your home mortgage needs may be, there is an appropriate loan offered for you. Utilize this helpful guide to assist understand the various types of home loans available to homebuyers - what kind of people default on mortgages. A fixed-rate home mortgage will lock you into one interest rate for the entire regard to your home mortgage. The advantage of this is month-to-month payment security over the length of your home loan.

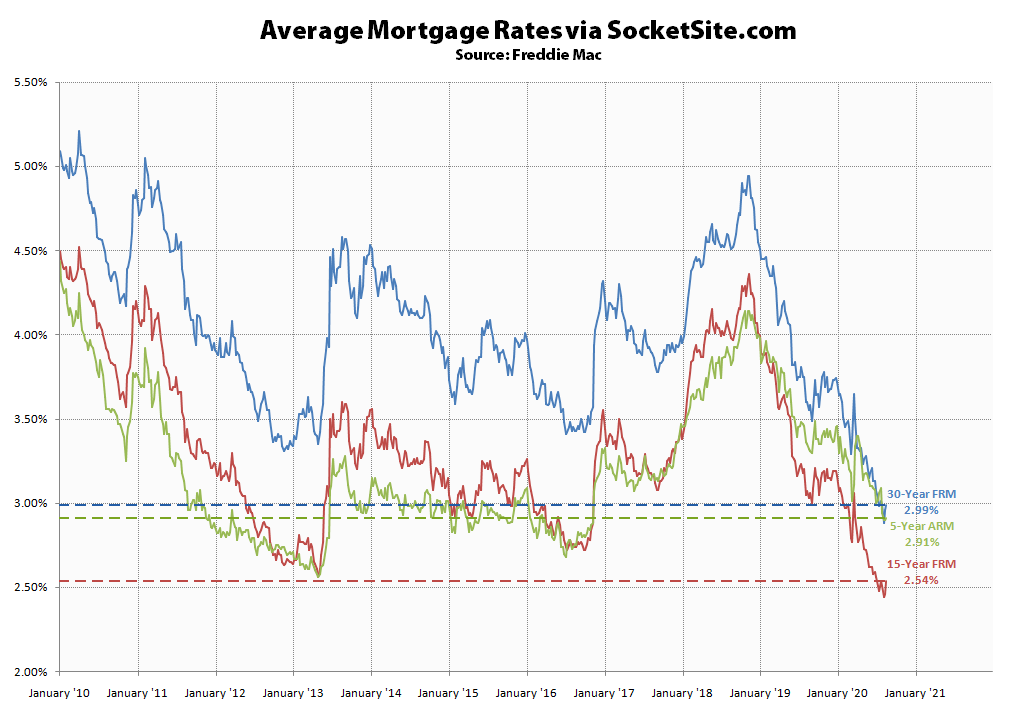

An adjustable rate home loan generally adjusts the loan's rates of interest when a year, and locks into that rate for the whole of the year. ARMs are typically riskier due to the fact that Get more info the payments can increase depending upon rates of interest. The objective of an ARM is to benefit from the most affordable rates of interest available, assuming your income may increase in time as the rates of interest potentially changes upward.

The 45-Second Trick For What Are Cpm Payments With Regards To Fixed Mortgages Rates

An intermediate or hybrid home mortgage starts as a fixed rate home loan for a number of years, and after that becomes adjustable. 10/1 ARM: In this ARM, the rate of interest is repaired for the first ten years of the loan, and after that ends up being adjustable every year going forward. 5/1 ARM: This works the same as a 10/1 ARM, but the loan would end up being adjustable after 5 years.

There are typically some limitations, like just having the ability to secure within the very first 5 years. This is different from refinancing, because you will not have the choice to change again, but rather will be secured. Locking in to a fixed rate may sustain a charge or have a charge connected with it.

You will typically require to have outstanding credit, an appropriate debt-to-income ratio to support a big loan, and the down payment will be significant since of the cost of the home. Payments made on a balloon mortgage will normally be lower than average, and in some cases will just be interest payments.

This results in a huge payment at the end of a relatively short-term. These mortgages are typically gotten commercially, and are gotten by those planning to offer a residential or commercial property in the future. A loan with no Click for info down payment used only to veterans. The deposit for a VA home mortgage is assisted by the VA.

This loan is excellent for first time home purchasers, those that can't manage a regular deposit, or those with poor credit. If you can pay for a 5% deposit, choose a traditional loan to get a better interest rate. For more details and help comprehending the different types of mortgages that may be a great suitable for you, get in touch with one of our Pentucket Bank Mortgage Officers.

We constantly retain maintenance of our loans, so you can constantly reach us locally for questions during the life of your loan. Send us an e-mail or provide us a call today at (978) 372-7731 to discover how we can assist you as you consider your house loan alternatives.

Get This Report about What Mortgages Do First Time Buyers Qualify For In Arlington Va

Now is a fun time to do some research study to better comprehend the types of loans that are readily available to you. When you're prepared to get out in the market, you'll feel more positive understanding which one is the right type for you. One of the initial steps in purchasing a new house is deciding how you'll finance it.

There are several kinds of mortgage available, so you can pick the home loan program that best suits your monetary circumstance. A home mortgage loan officer can assist you arrange through your alternatives, however here are some of the essentials to assist get you started. When you're comparing different types of home mortgages, you need to look at these bottom lines: House requirements Customer requirements How mortgage payments are structured Not all kinds of mortgage will work for all purchasers, so it's useful to speak with your loan provider to arrange through the finest choice for you, especially after learning the recent federal rate cuts due to COVID-19 (how would a fall in real estate prices affect the value of previously issued mortgages?).

The matter of fixed-rate versus variable-rate mortgages will enter play with nearly all kinds of mortgage programs. As the name recommends, a fixed-rate home loan is one that maintains the very same rates of interest throughout the life of the loan. With an variable-rate mortgage (ARM), the rates of interest can change after the preliminary fixed-rate duration, which might be between 1-10 years.